Cryptocurrency in India and Its Effect on the Economy

Now in India you can use Cryptocurrencies to buy goods & services. Not everyone but few service providers have started to give recognition to Cryptocurrencies, like Bitcoin, Ethereum, Solana, and other crypto tokens in exchange for goods and services. So, this is small but a good start for everyone. Cryptocurrencies are more and more gaining in importance as a mode of payment in the middle of the small yet growing set of businesses in the official and unofficial business in India.

Crypto & Blockchain has the supremacy to interrupt human life as we know it. Just like how it was hard to imagine the effect and prospective of smartphones before the beginning of Android & MAC, the possibilities around Cryptocurrencies are only limited by human imagination and acceptance presently.

Blockchain technology is a decentralized system to boosting confidence and value. That is, a middle man is not necessary for transactions between two parties. Generally, we do several payments in a day with individuals/service providers digitally through debit/credit card/e-wallet provider, we pay for broadband, children's education, food, transport, and even rations. Here, the intermediary works as a trustable source to make sure the transaction is authenticated on both sides and for this take a proportionate cut of the value transacted.

Future of Cryptocurrency in Indian Economy

Establishing Utility

Many crypto exchanges in India have allowed their users to recharge their Fastag, pay utility bills, and shopping in e-commerce. According to the reliable source from a reputed crypto exchange in India, “from the time when Bitcoin top-ups are available for Fastag, it has seen rising numbers of the transaction to the tune of approx Rs. 10 Lacs in the last 3 weeks, half of which were made by those aged around 40.”

The crypto exchanges want to revive the original objective behind the formation of Bitcoin, which was “quick and free payment” from anywhere & anytime in the world without a middleman, and to make bigger its use cases for retail traders, which at this time stand over 15 million in India as per industry estimates.

The Central Government of India has recently assembled a division to control crypto regulation and many service providers are positive that if many big brands implement it, then the high authority will also be able to see that the Crypto is definitely the future.

On the other hand, the Reserve Bank of India (RBI) is very concern about Cryptocurrencies and is considering banning the use of crypto. Central Government, in contrast, has shown its preference toward categorizing crypto as a top-class, just like gold.

Monetary systems and asset class

As an asset class, Crypto offers a level global investment platform, regardless of nation of origin. Cryptocurrencies are expanding and naturally have faced opposition from RBI. In India, even private banks have not been approaching in supporting the network and its start-ups. But the best thing is that a large number of investors (in millions) have adopted crypto through legal exchanges that support the exchange of the India Rupee to different digital currencies.

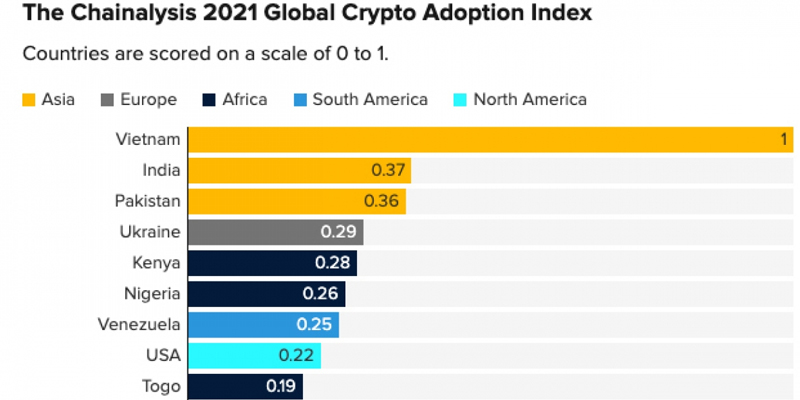

The rising acceptance has ensured a considerate but impactful approach from the Central Government of India. Now Government of India is considering legalizing the Cryptocurrency space to look after and serve investors’ interests and RBI has declared to form a Central Bank Digital Currency (CDBC) based on Blockchain technology. If everything will be fine then India by itself will have approx 100 million users within few months – leading to worldwide domination as highest numbers of users.

Innovation and Trade

At this time, Blockchain-based corporations can easily work in India and set their control in the rest of the world. Future advancements in the Cryptocurrency/Blockchain arena can come from our country and it can also create new opportunities for employment and economic development. Numerous Blockchain systems with international implications are at this time being developed in-house.

“Matic Network” an Indian Blockchain scalability platform, making a protocol and structure to link Blockchain-based systems and is considered as a top contestant for defeating network concerns faced by Ethereum. Ethereum is one of the top Cryptocurrencies by market capitalization these days.

Companies like Matic Network will grow and through a huge talent base, can do outstandingly on a global forum. A locally developed DeFi (decentralized finance) solution that can harmonize the conventional financial system internationally will allow for financial insertion as well as present an alternative. New start-ups and future firms get registered in the ISE (Indian Stock Exchange).

Proportionate to international trade, India’s reliance on the dollar can finally be lessened if international trade shifts to a decentralized Cryptocurrency. Export-oriented businesses in India can have good expectedness for deals and payments.

Cryptocurrencies’ future in India is prosperous with lots of possibilities. With the great amalgamation right parameter and encouragements, Cryptocurrencies and Blockchain have the prospective to boost the Indian economy.

Pros and cons of real estate transaction through Cryptocurrencies

As we know that Cryptocurrencies & Blockchain in India needed support from service providers & consumers to settle as a big monetary system in the upcoming years. Yes, it is true that it will take a long time & a huge effort to reach maturity and gain interest & faith. The real Estate of India also holds lots of opportunities & good scope for Cryptocurrencies.

The advantages of using Cryptocurrency in real estate transactions are:

- Efficiency, because Cryptocurrency transactions take place instantly and normally take only minutes to verify;

- Small fees, as there are fewer middlemen in Cryptocurrency transactions than in conventional real estate deals;

- Maximum privacy when purchasing property thanks to the unidentified nature of Crypto wallets;

Alternatively, using Cryptocurrency to conduct real estate transactions also has its disadvantages, like:

- Instability, with Crypto rates, frequently fluctuating dramatically;

- Security threats from hackers and scammers;

- A lack of options for lost or stolen funds; and

- Difficult tax implications.

Conclusion

If everything goes well then future of cryptocurrencies in India is set with endless opportunities. What we need is Central Government approval with right set of regulations & incentive. And the best thing is, this technology has the power to boost the speed of India towards Atmanirbhar Bharat.