Budget 2022 Highlights - The Whole Details At Glance

.jpg)

Due to the global revolution, Budget 2022, including infrastructure, health, education, and the introduction of e-services to the masses, has also been formulated. 'Amrit Kal' is the blueprint for the economy over the next 25 years - from 75 to 100.

The Indian economy grew by 9.2%, the highest growth rate among all countries. We have been able to combat the Omicron wave significantly with our vaccination campaign. It is expected that Sabka Prayaas will continue to grow. Capital expenditures and public investments have been dramatically raised in Budget 2022.

Railway Budget:

Finance Minister Nirmala Sitharaman allocated Rs 1, 40, 367.13 crores to the Ministry of Railways in this budget. There have been several announcements made in the budget including the production of 400 semi-high speed Vande Bharat Bharat Express trains with the concept of ‘One Station One Product’ to encourage the local businesses, bringing 2,000 kilometers of the railway network under Kavach. It is noteworthy that several states have seen tremendous growth under different stages of planning/implementation.

- Rs 6,606 Crore has been allocated to Bihar

- Rs 7,032 Crore has been allocated to Andhra Pradesh

- Rs 1,064 Crore has been allocated to Delhi

- Rs 1,400 Crore has been allocated to Haryana

- Rs 4,745 Crore has been allocated to Gujarat

- Rs 1,780 Crore has been allocated to Himachal Pradesh

- Rs 5,983 Crore has been allocated to Jammu and Kashmir

- Rs 5,058 Crore has been allocated to Jharkhand

- Rs 6,091 Crore has been allocated to Karnataka

- Rs 1,085 Crore has been allocated to Kerala

- Rs 12,110 Crore has been allocated to Madhya Pradesh

- Rs 11,903 Crore has been allocated to Maharashtra

- Rs 9,734 Crore has been allocated to Odisha

- Rs 7,565 Crore has been allocated to Rajasthan

- Rs 3,048 Crore has been allocated to Telangana

- Rs 3,865 Crore has been allocated to Tamil Nadu

- Rs 10,262 Crore has been allocated to West Bengal

- Rs 5,715 Crore has been allocated to Chhattisgarh

Direct taxes- Income tax:

- Startups are eligible for a one-year tax incentive extension. From now until March 31, 2023, startups incorporated under Section 80-IAC will be eligible for tax benefits.

- Reduced from 12% to 7% the corporate surcharge

- Co-operative societies will receive a 15% alternative minimum tax (AMT)

- Transfers of digital assets, such as crypto, will be taxed at 30%

- Employers are required to contribute 14% of their pay to the Tier-I account of the National Pension Scheme (NPS)

Indirect Taxes – GST & Customs:

- Sections 16, 34, 37, 39, and 52 of the Central Goods and Services Tax Act have been amended significantly. To make amendments, corrections, upload missing sales invoices or notes, or to claim any missed Input Tax Credit or Input Tax Credits for one financial year, you need to make changes before 30 November of the following year, and not by September.

- Earlier known as furnishing of inward supplies, section 38 now refers to the supply of details of inward supplies and input tax credit. It is replaced by GSTR-2A and GSTR-2B with a new heading 'Communication of details of inward supplies and input tax credit'.

- NON-RESIDENT TAXABLE PERSONS are required to file GSTR-5 by the 13th of next month, instead of the 20th of next month.

- Several sections were deleted referring to matching, reversal of tax credits, including 42, 43, and 43A.

- The gross GST revenue collection of Rs.1,40,986 crore in January 2022 was the highest since GST was implemented.

- Imposition of 7.5% duty on capital goods imports to phase out concessional customs duty.

- There will be a phase-out of more than 350 exemptions on the importation of certain agricultural products, chemicals, drugs, etc.

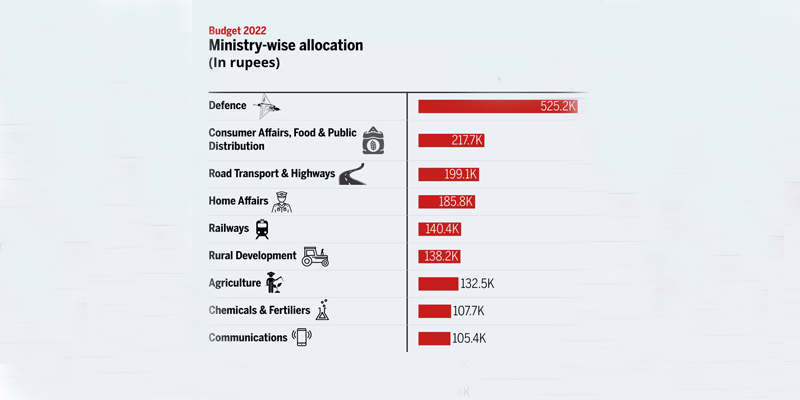

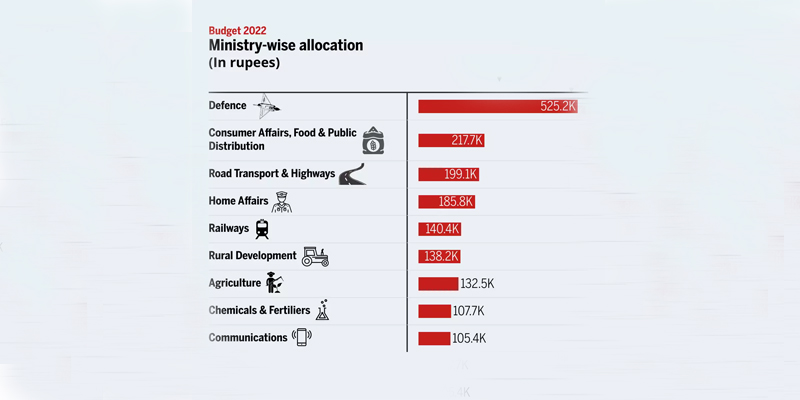

Budget allocation:

- In FY23, India is projected to have a fiscal deficit of 6.4%

- The revised estimate of 6.9% fiscal deficit

- To help fund PM Gati Shakti-related investments, states will receive Rs 1 lakh crore in interest-free loans over 50 years

- In 2022-23, the government anticipates an effective capital expenditure of Rs 10.68 lakh crore or 4.1% of GDP

- A sharp increase of 35.4% is anticipated in capital expenditure from Rs 4.54 lakh crore to Rs 7.50 lakh crore in 2022-23

Education:

- Improve the health of 2 lakh Anganwadis by upgrading them.

- School-going children have been regressing in their education for two years, which means we must step up our efforts and increase our spending. The NEP called for 6% of GDP to be devoted to education.

- Set up a digital university that focuses on ICT via a hub and spoke model.

- ITIs offering skilling courses in all states should be selected.

- From 12 to 200 TV channels will be included in the "One class, one channel" program of PM eVIDYA. As a result, all states will be able to offer supplementary instruction in regional languages to students in grades 1 through 12.

Startups (Drone, etc)

- Industry and startups will have access to defense R&D.

- Startups will be facilitated to promote drone usage using 'drone shakti'.

Agriculture:

- A government fund to be used for sunrise opportunities such as climate action and agri-tech (government shares limited to 20%)

- Providing funding to agriculture and rural businesses that contribute to the value chain of farm products through the NABARD. Entrepreneurs will work with farmers to provide technology

- It is proposed for Kisan Drones to be used for crop assessment, land digitization, insecticide spraying, and fertilizer spraying

- Wheat will be purchased in Rabi season 2021-22 and paddy in Kharif season 2021-22, which will result in the direct payment of MSP value to the accounts of 1208 lakh metric tons of wheat and paddy from 163 lakh farmers

- Hi-tech services will be offered to farmers

- The direct transfer of MSP to bank accounts for farmers

- India should promote chemical-free natural farming

Investment, Sectoral allocation:

- An expert committee needs to be formed to review the venture capital regulatory framework.

- The North Eastern Council will implement PM development initiatives for the northeast. Women and youth will be able to participate in livelihood initiatives. The program does not replace the existing state and federal programs.

Virtual currency:

- Blockchain technology will be used by the RBI to introduce the digital rupee in 2022-23.

MSME:

- We will begin the next phase of making living and doing business easy.

- Lending to the MSME sector will benefit from the extension of ECLG. Soumya Kanti Ghosh, director of SBI's market analysis division, says the revamp of CGTSME will provide banks with an added incentive to extend credit.

- Experts say the extension of the ECLGS (emergency credit line) until March 2023 is a critical move.

- To improve the resilience and competitiveness of MSMEs, the government took measures.

- 130 lakh MSMEs were able to mitigate the worst impacts of the pandemic with the Emergency Credit Line Guarantee Scheme.

e-Vehicles And Energy

- The promotion of energy efficiency and savings measures will be carried out.

- An EV ecosystem boost will be brought about by a battery swapping policy and interoperability standards.

- The FM announced an allocation of Rs 19,500 crore for solar modules in the PLI.

Digital Banking:

- To reduce payment delays, an online bill system will be implemented. This will benefit all central ministries.

- This is the highest credit growth in many years, growing by Rs 5.4 lakh crore.

Internet Connectivity:

- An auction for the 5G spectrum will take place between 2022 and 2023.

- The PPP model will be used for awarding Bharatnet project contracts for optical fiber networks.

- Digital resources should be accessible to all villages as well as urban areas.

Defence:

- In 2022-23, 68% of the capital procurement budget in defence will go to domestic companies.

e-Passport:

- To be introduced in 2022-23, e-passports will have futuristic technology.

- In 2022-23, India will begin issuing e-passports, according to the finance minister. Some of the proposed features were as follows:

- It will take seconds for the e-passports to be scanned.

- A laboratory affiliated with the US government tested the prototype.

- Covers are expected to be thicker on the front and back.

- A small silicon chip is expected to be found on the back cover.

- There will be 64 kilobytes of memory on the chip.

- The chip stores the holder's photograph and fingerprint.

- The system will be able to store 30 visits.

- The development of urban capacity is to be supported by the states.

Healthcare:

- It will be possible to create an open platform for the National Digital Health Ecosystem. Digital registries for health providers and facilities as well as unique health identifiers will be included as well as universal health access.

- Amid the pandemic, mental health has been brought to the forefront. Telehealth programs will be launched across the country.

Housing And Basic Amenities:

- The Affordable Household Scheme will be available to 80 lakh households by 2022-23.

- 3.6 crore households will get tap water with a budget of 60,000 crores.

- By contrast with last year's clear 34.5% increase to Rs 5.5 lakh crore, the value of the increase in infra spending through PM Gati Shakti's plan is unclear.

- With the Ken-Betwa link, irrigation will be provided to 9,05 lakh hectares, and 65 lakh people will have access to drinking water and solar power.

Employment:

- To realize Aatmanirbhar Bharat, the Production Linked Incentive (PLI) Scheme was excellently received, potentially creating 60 lakh new jobs and producing 30 lakh crore more over the next five years.

- A total of 60 lakh new jobs have been created through 14 PLI schemes across 14 sectors.

Highway Expansion:

- Twenty-five thousand kilometers of national highways will be added during 2022-23. As part of the public-private partnership (PPP) model, the national ropeway development program will be undertaken. The PPP model will be used to implement multimodal logistics parks at four locations.

- Kisan Drones, chemical-free natural farming, and public-private partnerships will be promoted by the government to provide digital technologies and high-tech services throughout the country.

Import Duty On Cut Diamonds:

- A 5 percent reduction in import duty will be applied to cut and polished diamonds and gemstones, and a nil reduction will be applied to sawn diamonds. Diamonds and gemstones are subject to a 7.5 percent import duty at the moment.

- It is planned to give data centers and storage systems infrastructure status to make financing easier for them.

- Private companies will conduct spectrum auctions to roll out 5G mobile services by 2022-23.

- No one from the opposition raised their voice even once during the finance minister's speech.

- For the first time in pre-election budgets, no votes are being sought at this time.

No Halwa Ceremony:

Due to the prevailing pandemic situation and the need to observe health safety protocols, sweets were provided to employees who were to undergo "lock-in" at their workplaces instead of halwa ceremonies held every year, the ministry said.

During the period leading up to the presentation of the Union Budget, all officials and staff are housed in Budget Press within North Block. They will be in touch with their near and dear ones only after the Budget is presented by the Union Finance Minister to the Parliament," it stated.

2047- Longer View For Success And Stability

In this budget, a long-range view has been taken from a helicopter. Budgets are designed to provide national governance, integrate state and federal government functions for the common good, and digitize the physical, economic, financial, and technological domains of the country into a single computer system.

The digital agenda is going to be massive, and if it is accomplished, then it will eliminate most leaks and other evils in government; corruption - the root cause of the country's physical and economic uncertainty - will be eradicated.

Conclusion:

Finally, if we look at the planned initiatives that will be taken in the Budget 2022, we can determine that the bulk of sectors will benefit and be neutral. Generally speaking, the budget is received positively and if somehow the government manages to implement the budget properly, then it will result in quality growth, an improved economy, enhanced digitization, etc.