The first thing you need to consider before you consider buying commercial property is why you want to do so. Investment in a commercial property is pointless if you do not know what you hope to achieve with it. Consider your "why" before investing and then determining your "what". Search for an investment that will help you achieve your goal after determining what you want to accomplish. Commercial property can be acquired in a number of different ways:

- Investing in land for future development is known as land banking. The value of land increases as development advances.

- Buying raw land and transforming it into properties is the result of commercial real estate development.

- Buying commercial real estate, making repairs, installing upgrades, and reselling at a higher price is called "fix & flip".

- An investor or owner-occupant purchases a property under contract, and then sells it to another investor or owner-occupant.

- Buying a piece of commercial real estate and setting up your own business there is an owner-occupied strategy.

2. Deliberate Your Investing Options

The term commercial real estate covers a wide variety of types of properties, including retail shops, industrial complexes, office buildings, large apartment buildings, and many others. It is generally defined as property to be used for business purposes. As a result, you should decide which type of commercial real estate you want to deal with. Keep in mind because you are investing in the first place to help you make the right decision.

3. Secure Financing option it is

Before you look for a commercial property to purchase, try to secure financing. As a result, you'll not only know what you can afford, but you'll also be able to effectuate a deal more quickly with the money at your disposal.

4. Bring into line Yourself with The Right People benefiting you

A lot of people are involved in the real estate business, and acquiring a commercial property is no different. Choosing a professional who can help you with this process is important. If you plan to complete a commercial real estate transaction, you might want to contact an experienced commercial real estate agent, a commercial real estate attorney who understands the laws of commercial real estate, and a certified personal accountant (CPA) to make sure that everything goes smoothly. You can get help from several professionals, so ask for assistance if you need it. You can land the deal you've always wanted with the right partners.

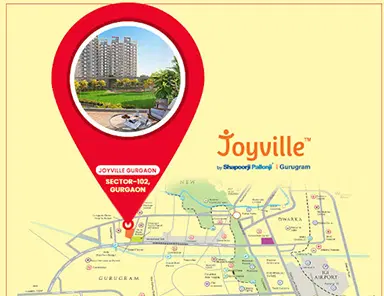

5. Find A Property That Matches Your Criteria

Start your search after the necessary preparations have been made. You should already have an idea of what you want; stick with it. If you're considering commercial property, keep in mind why you're buying it, and make sure it will get you to your end goal. Even if the property seems like a great deal on the surface, there's no point in buying it if it doesn't help you achieve your goal.

6. Attention Due Diligence

You can't buy a single-family home or a commercial property at the same time. Be careful before making a purchase. Do your homework before buying. Does the risk outweigh the reward? Are there other properties that are better suited to your needs? Analyze all details now. Once you are sure that the property will benefit your portfolio, only move forward.

7. Close The Deal Immediately

Make an offer with a contingency clause as soon as you find a property worth pursuing. If the commercial property does not pass the inspection, make an offer with an inspection contingency. Ensure that the appropriate insurance is set up and that all documents included are reviewed if everything looks good. Make sure you are prepared for a transaction involving commercial real estate.