Affordable homes in India are undoubtedly one of the biggest contributors to the total demand for residential properties, but still, this segment needs more attention from the real estate developers, let’s know more about it.

Within the booming real estate of India, affordable housing comes as an opportunity for the economically weaker and middle-class homebuyers. With the rise of the middle-class section, the potential of affordable homes is also boosted. As well, due to its wide target market, the affordable housing market is less vulnerable to the moods of the market fluctuation.

Definition of Affordable Housing

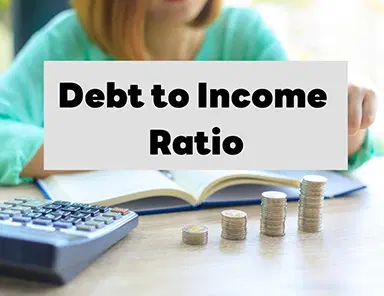

‘Affordability’ is a broad-based term; the meaning of this term varies from class to class. For example: - a specific item that is affordable to rich segments like branded cars, not affordable to the middle class. Accordingly, there is not an exact definition of affordable homes that can be applied consistently commonly. The meaning and space of affordable homes are significantly depending on a nation’s economic conditions.

In India, many reputed real estate agencies have jointly developed definitions of affordable housing for Tier I, II, and III cities, based on 3 important parameters –income, size, and affordability.

|

Income Categories

|

Income Level

|

Size of unit

|

Affordability

|

|

Economically Weaker Section

|

INR 150,000 per annum

|

Up to 300 sq. ft.

|

EMI to monthly income – 30 to 40%

|

|

Lower Income Group

|

INR 150,000 to 3000, 000 per annum

|

Up to 300 sq. ft.

|

EMI to monthly income – 30 to 40%

|

|

Middle Income Group

|

INR 300,000 to 1 million per annum

|

600 to 1200 sq. ft.

|

House price to annual income – less than 5.1x

|

Rise of Affordable Housing

A decade back global economic slowdown has transformed the business climate, driving real estate developers to focus on affordable residential projects.

Before the economic slowdown, construction activities in the real estate sectors were financed by the advance payments collected by the home buyers. So, construction activities were only relied on the advance payments by home buyers. This model operated well during times of the real estate boom when there was a big demand for luxury residential property.

But, the economic slowdown of 2009 and a deep silence in demand for residential properties revealed the paleness of this model. With the dropping demand of residential properties, collection from advance payment also declined, and real estate developers were in trouble of liquidity crunch. Consequently, construction activities were hampered, residential projects were delayed, and occasionally, builders had to turn to distressed sales at very low prices.

This emergency saw the concept of affordable homes rise in India. The big appeal of affordable homes led to volumes outpacing that for luxury residential properties and boosting collections from booking amount. As well as, affordable development costs of these residential projects helped to extra support in developers’ finances.

The demand for affordable housing is continuously rising

The current position of infrastructure in urban cities leaves much to be expected. Availability of affordable homes, especially, is the biggest concern – about 80 million families are living in the slums with a desire for an affordable home. With the rise of the middle-class segment in India, the demand for affordable homes is also expected to rise.

Key factors bolstering growth in demand for affordable housing are: -

Rapid Urbanization – By the end of this decade, the total population of India is expected to reach the mark of 590 billion. The percentage of the urban-to-total population is expected to increase from 30% in 2010 to 40% by 2030.

Demand for affordable homes – With home value far beating general inflation and wage growth, luxury homes in the big cities have become largely too expensive, leading to the demand for affordable housing.

A desire for homeownership – Every India has a leaning towards homeownership. Even the low-income group is also determined to purchase an affordable home, rather than rent one.

Initiatives for affordable housing

How Central Government support developers in affordable housing projects?

Housing For All

The Central Government has introduced the ambitious ‘Housing for All’ scheme in 2015. Its objectives are to achieve the mission of providing affordable housing for all income groups by the end of 2022. This scheme comes under the Pradhan Mantri Awas Yojana (PMAY), targeting to present affordable housing to the Economic Weaker Section.

GST rates for affordable housing developments

The GST Council has reduced the GST rates from 8% to just 1%, for residential property up to Rs. 45 Lacs. This means houses purchased under Rs. 45 lakhs will be exchanged at the lowest GST rate of 1%. Consequently, interest rates for housing finance are bound to become more rewarding.

RBI efforts in the affordable housing scheme

RBI has directed the banks to raise the limits of affordable housing loan eligibility under priority sector lending for the buy/construction of a home. As per the revised RBI recommendations, affordable housing rates should not be above Rs. 65 Lacs in big metropolitan., and Rs. 40 Lacs in other cities.

Current Situation of Affordable Housing

At this time, real estate developers are launching residential projects in the luxury & mid segments. According to the data, more than 1.60 lacs units were launched between January to September 2021, 40% was in the mid-segment, while nearly an equal number of launches were seen in the affordable & premium segments.

On the other hand, if we talk about 2019 in the pre-covid era, the share of affordable housing was more than 40% of the total launch. So, there is a decline in the new affordable launch from the developer side.

What’s now for Affordable Housing?

In the age of the Covid-19 pandemic, the demand for affordable homes has not vanished but buyers seem to have gone into a waiting mode for some time. Affordable homes demand is expected to gain speed once the financial impact of the Covid pandemic begins to lessen.

Honestly, affordable homes have maximum demand or needs in our country. And India has a huge housing shortage and by constructing homes in the affordable segment this issue can be addressed perfectly.