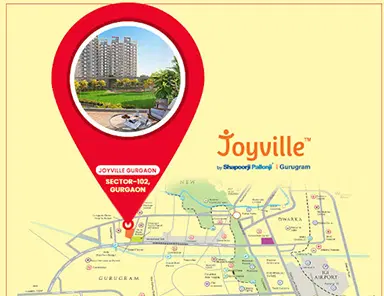

UAE, Dubai

The UAE is the most preferred choice for real estate investors and Dubai in UAE is the most thriving location with numerous advantages. Dubai is among the real estate investment best cities because of its higher rents and profitability in addition to its low tax rate. The UAE's citizens' superior purchasing power drives the real estate industry. Consequently, it is a wonderful moment to purchase real estate in Dubai. Both the economy and the people are growing, helping Dubai's real estate market.

In the first quarter of 2023, the Dubai Realestate recorded its all time high transaction. During this period total 36,946 deals were registered (43.2% higher compared to the 2022). If we talk about the Year-on-Year increase for April 2023 then it was approx 16.2% The year-on-year increase for April alone was 16.2 percent. So, there is almost half a year left for 2024 and the future is bright for real estate investors.

Let's evaluate the other factors that make the decision of real estate investment in Dubai perfect for foreigners.

Cost of Living in Dubai

Dubai is an expensive city compared to other UAE locales. Cost of living index estimates that a single person in Dubai needs about 3,700 United Arab Emirates Dirham (AED), or $1,000 USD per month, excluding rent. For more information you can read our blog cost of Living in Dubai.

Foreign Ownership Laws in Dubai

As per Article 3 of Regulation No. 3 of 2006 determining areas for ownership by foreigners of property in the Emirate go Dubai (pages 129 - 132) indicates the land plots designated as freehold properties. In UAE and particularly in Dubai Foreign Ownership is permitted in freehold areas & communities. This means that any foreigner or expat can buy property here but only within the boundaries of these freehold areas. For more information you can read our blog Real Estate ownership rules for foreigners in Dubai.

Tax Liability in Dubai

The most recent update regarding this matter has been provided through the unveiling of Cabinet Decision No. 56 of 2023, pertaining to Federal Decree-Law No 47 of 2022. According to this announcement, foreign companies and non-resident juridical persons are now required to pay a 9% tax on all income derived from real estate and other immovable properties within the country. This tax applies to properties held for investment purposes or utilized for business activities.