Knowing the details and the hopes from coming year for the tremendous growth - 2022 is going to be a fantastic year.

- As per the Anarock report, new supplies for the residential sector increased by 27% between Jan and Sep 2021 compared to the same period in 2020, and sales increased by 5%.

- No matter how challenging and eventful the year has been, the real estate sector has seen a b rebound, according to Mohit Goel, MD, Omaxe Ltd. Boosted by the b economy, real estate gains quickly gained momentum.

- The Managing Director of Krisumi Corporation shared an explanation of the trends and customer preferences, saying, "Work from home is emerging as the dominant undercurrent to shape the preferences of homebuyers in 2022. The city's periphery will remain the most sought-after region and flexible work options will continue to shape the housing market in innovative ways."

- As Vivek Singhal, CEO, Smartworld Developers, explains, "the virus has refurbished the real estate market, and developers now prioritize individuality and customer-centricity as their top concerns. Innovation and digital transformation will drive the bang in the real estate market over the next year. The period of 2021 has given rise to an asset class of independent floors in gated communities, and we expect this trend to continue."

High-end property deals are nothing more than numbers to the ultra-rich, particularly for homes costing between Rs 80 crores and Rs 1,000 crores. Despite the pandemic, Delhi continued to epitomize this syndrome in 2021 with industrialists piling into super luxury bungalows. Property experts predict that the trend will persist in 2022, as well. The most amazing trend and rise has been witnessed in Delhi and Mumbai with people focusing majorly on luxurious properties.

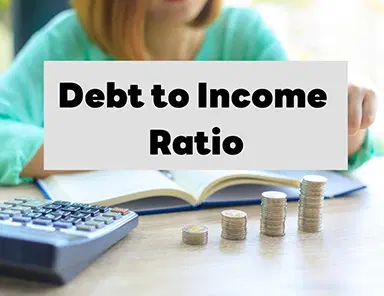

- Maharashtra's government decided not to extend the stamp duty waiver on March 31, the day several transactions were recorded in the Mumbai market. Despite this, buyers of luxury ready-to-move-in properties have continued to buy them from industrialists to diamond merchants until the end of the year.

- As well as in Delhi's Lutyens' zone and other luxury markets such as West End and Vasant Vihar, several bungalow sales were completed. Two branded players have recently announced plans to enter this segment - Godrej Properties and Tata Realty and Infrastructure.

- Godrej Properties said it has entered into a joint venture with the TDI group to construct a luxury housing project in Connaught Place and Tata Realty and Infrastructure plans to develop the project near Hailey Road. By 2023, Tata Realty and Infrastructure intends to invest close to Rs 200 crore in the project.

- During both waves of the pandemic, experts say, Mumbai saw an increase in demand for independent houses in the ultra-luxury segment, particularly above the Rs 100 crore levels. According to Ritesh Mehta, Head Residential Property Sales at JLL, the limited availability of such bungalows will result in decent appreciation over a period of three to five years.

- K Raheja Corp, the Mumbai-based developer of the 60,000-square-foot project, kept possession of three floors in one of India's biggest high-rise deals. ft and worth Rs 426 crore. In Worli, the 45-story Artesia tower, an iconic landmark with views of the Arabian Sea and the Bandra Worli Sea Link, stands as an iconic standalone tower.

"In addition to bungalows, there is enormous demand for Jodi’s or houses consisting of four units that are purchased by one family. People want to be with their friends and family during this time. Prior to now, they bought luxury apartments in different developments, but now they are buying apartments on the same floor. Therefore, it should come as no surprise that a tower with 180 units has no more than 100 families," he says.

According to Mehta, demand for the few and far between ready-to-move-in luxury homes that exist today is expected to continue through 2022. Industrialists, companies, stockbrokers, and IPO investors are among the segments selecting these units.