Buying a home is neither nerve-wracking nor that simple. You need to be clear with all the points before you buy a home.

In 2022, will you be ready to take on the challenge of purchasing a home? There is a lot of work involved in buying a home, but these steps can make the process more manageable and help you make the right decisions.

Budget not putting strain on you:

A monthly budget must be planned to be able to determine how much money is left over for your expenses. The first property you buy will rarely be the last one you buy, so pay attention to your current property needs first, and let the long term take care of itself. If you are purchasing a property, make sure that it will fit your current needs and be within your budget. When purchasing a property, you will be better equipped to make the right decision if you understand your family's present major needs.

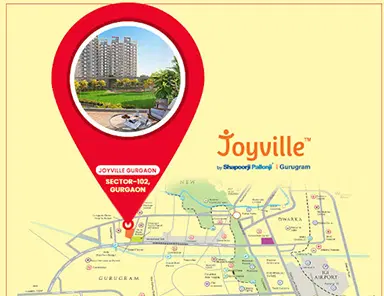

Location i.e. beneficial from every corner:

Consider the location and the neighborhood well before making a decision. The best thing to do is to select a place that is not too far from your city's center so that the price won't be too high. You need to consider the location of your home when determining its resale value. You may be able to maximize the value of your home if you choose wisely.

Reasonable Rental rates in the area:

Rent-high or highly populated areas are ideal places to invest in rental properties. Understanding the rental rates in the area can enable you to select the best property and location.

Good Resale Value:

Before you buy or invest in a property, you must consider the resale sale value. Most buyers do not consider this factor when they buy properties. In their quest to find the perfect property, they mistakenly concentrate on a prime location or the budget. You may always sell your home for less than the homes next to it if you choose the wrong property or location.

Check your Loan eligibility:

A house loan applicant's eligibility depends on several factors, including his or her income, debts, and repayment capacity. To calculate the loan eligibility of a home loan borrower, lending companies and banks offer online services like home loan eligibility calculators. According to bank regulations or RBI regulations, the maximum loan amount that can be sanctioned varies. A borrower's loan eligibility becomes more difficult as interest rates rise.

Stamp Duty & Registration Fee:

Similar to the government's income tax and sales tax, this is a significant expenditure or tax. You need to know the rates and charges for your city when planning your budget for buying a property. You must contact the Ready Reckoner to locate the valuation zone and sub-zone of your property if you want to know its market value and stamp duty amount.

Additional Costs, if any:

It is important to use a team of professionals even if this is not your first home purchase. It is important to consider fees or service charges charged by real estate agents, lenders, mortgage brokers, home inspectors, land surveyors, lawyers, and notaries, etc. Check out the maintenance charges as well. Does parking come with the building and is it included in the rent? You can ask the secretary of the society for a parking lot if your previous owner did not own a vehicle.

Property insurance, importantly needed:

In the event of damages to your property, property insurance protects your financial future. If a title issue, certain damages, or any legal issue should arise, the cost is relatively low. There are different levels of protection available for home insurance policies. You need a trusted resource to guide you when you are deciding to protect your major assets. You can protect your home and ease the purchase process by choosing the right house insurance.

Final Thoughts on home buying

The steps to buying a house can make for a longer overall process. But it can be one of the best decisions you will make in your life.