By following 10 steps they can make their home buying experience untroublesome and make the best decision.

Generally, first-time homebuyers face many troubles and spend lots of time & energy.

Start Your Investigation Early

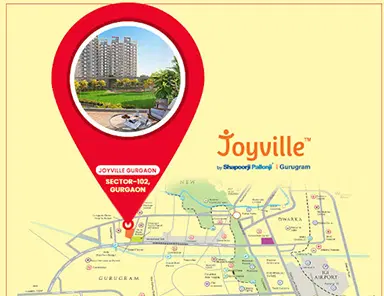

The instant you can start exploring real estate websites, real estate columns in newspapers, and magazines that have good information. Make a note of particular residential projects in Gurgaon that fit your requirements like Shapoorji Pallonji Joyville Gurgaon & Conscient Elevate etc. and see how long they stay on the market. Also, keep a record of any changes in asking prices. This will give you an idea of the property trends in a specific locality.

Determine How Much House You Can Afford

Home loan institutes generally recommend that people hunt for properties that cost not more than 3 - 5 times their annual household income if the home seekers plan to pay a 20% down payment and have a moderate amount of other financial commitments.

But different people have their priorities, so you should make this determination based on your financial conditions.

Get Prequalified and Preapproved for Home Loan

As we mentioned in the upper paragraph, you need to determine how much you can spend. The only way to do that is to get prequalified and check your eligibility for the home loan, for this you need to honestly provide some financial information to the banks, such as your income, savings, and investments have. After that, the bank will check & review this information and tell you how much home loan they can lend you. This will make it clear that how much home loan you will get and how much you need to arrange from other sources.

Later, you can get preapproved for the loan, which includes providing your financial documents like: -

For Salaried Individuals:

- Form 16

- Certified letter from Employer

- Payslip of last 2 months

- Increment or Promotion letter

- IT returns of past 3 years

Self Employed:

- Income Tax Returns (ITR) of last 3 years

- Balance Sheet and Profit & Loss Account Statement of the Company/Firm (duly attested by a C.A.)

- Business License Details (or any other equivalent document)

- The license of Professional Practice (For Doctors, Consultants, etc.)

- Registration Certificate of Establishment (For Shops, Factories & Other Establishments)

- Proof of Business Address

Find the Reliable Real Estate Agent

Many first-time homebuyers think that they can buy a home without any help but this is not achievable. Real estate agents or advisers the guide in your home buying journey. They can provide you lots of important information about real estate developers in Gurgaon and locality, that you cannot yourself. Their acquaintance of the home buying process, negotiating skills, and knowledge of the locality you want to inhabit can be very treasured.

Shop for Your Home and Make an Offer

Start site visiting the communities that are comes in your budget. This is a very important step to take note of all the homes you visit. You will visit a lot of residences and it is very hard to remember anything about them, so you can take a picture or make a video to help you remember important features.

Take care to check out every single detail of each residence. For example:

- Test the plumbing work by running the shower to check the water pressure

- Check the switches and wiring conditions in apartments

- Check the condition of the doors & windows (if they work properly during open and close)

It’s also important to assess the neighborhood and check the features such as:

- Are the other residences on the block well maintained?

- Check the traffic condition in peak hours?

- Is the community have enough parking space for the family and visitors?

- Is it conveniently located near important places like schools, malls, restaurants, metro, and bus stand?

Take your time to find a perfect home for your family. Then take the help of an experienced & reliable real estate agent to negotiate with the seller.

Get a Home Inspection

In most cases, purchase offers are depending on a home inspection of the unit to check for signs of damage or things that may need maintenance. In this case, your real estate agent generally will help you arrange to have this review conducted within a few days of your proposal being accepted by the current owner. This possibility protects you by providing you an opportunity to renegotiate your offer or withdraw it without penalty if the examination reveals huge material damage.

Both parties will get the report of home inspection and then you can decide if you want to ask the owner to fix the problem in that particular property before closing the deal or negotiate more.

Work with Banker to Select Your Loan

Everyone has their priorities when looking for a dream home and choosing a home loan. Many are interested in keeping their EMI’s as much as low with long tenure and others are interested in short tenure with high monthly EMI’s and so many priorities. For this, you need to take the assistance of a banker to get an appropriate loan.

Have the Home Appraised

The seller can hire an evaluator to give an impartial estimate of the home value that you are purchasing. The evaluator is an associate of a third-party firm and is not directly linked with the seller. The evaluator will let both parties involved to know that buyer is paying & the seller is getting the fair price of the property.

Coordinate the Paperwork

As you know, there is a lot of paperwork involved in home buying. Here you need to make sure that the seller is the legal owner of the unit you are purchasing.

Close the Sale

In the end, you will sign all of the documents required to complete the purchase, counting your loan documents. It generally takes 2 – 4 days for your loan to be funded after the important documents are returned to the lender. Once the payment is transferred to the seller, you can move into your new home!