Now you are ready to take one of the biggest investment decisions in your life – buying your dream home. It’s normal to feel excited & nervous simultaneously at this time.

Some of the biggest questions generally come in mind at this time are:

- Will I be able to get my dream home as per my expectations?

- How to get home loan and arrange down payment?

Determining how & where you are going to buy your dream home will help in get the best deal for lifetime. In this blog we have included everything that you will definitely need to keep in mind while buying a residential property for the first time.

To make this more understandable we have divided them into different categories.

- Preparing for the home buying

- Finding best residential property

- Best home loan option

- Avoiding first-time buyer mistakes

Preparing for the home buying

- Saving for your dream home

Home buying decision comes with the biggest cost that will not only consume your lifetime saving but also more. That’s why home buying decision is backed with years long planning & savings. This means you might have to hold back many other unnecessary expenditure like buying iPhone, foreign trip and many others.

Even with your lifetime savings & compromises on other expenditures, spending all that money to buy your dream home is not enough and then appears the requirement of home loan assistance (we will talk on this point in next paragraph).

It’s natural that you would want a home that not only looks luxurious but also feels comfortable from inside, large with many rooms, spacious and equipped with branded features. On the practical ground, you can only buy that comes in your budget. But you should try to find the best home that is close to what you have wanted and fits in your budget.

Finding best residential property

- Location and neighborhood

If you are still spending couple of hours in travelling between home & office every day after buying an expensive luxury home then this is a bad investment, and every first time home buyer should be careful.

The location & price of your preferred residential property should go hand in hand. As well as, the locality and security & safety level plays a big part in determine that how your life would be here. So, if you are selecting a location for your dream home we suggest you to checking:

- Ease of access

- Safety

- Basic amenities and facilities

- Proximity from schools, hospitals, malls etc.

- Travel time from you office

- Resale value

A perfect home

What is a perfect home for your family?

A home where kids have their own room, you have a separate space for Work from Home, a spacious kitchen embrace appliances and many other points depend on your expectations.

According to your requirement it could be 2, 3 or 4 BHK Apartment, Floor or Villas.

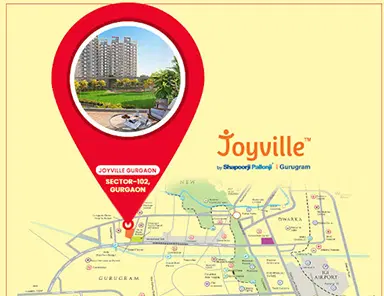

Just after the budget, spaciousness and features of the home are the important points. Real Estate of Gurgaon is filled with different types of residential options to buy like luxury apartments, floors and villas, Joyville Gurgaon Sector 102 is the best residential project. There are many other residential projects from reputed real estate developers in Gurgaon, so you have wide range of options to select the best for your family.

What you should look in your dream home?

Space

In the big cities space equal to liberty, more space means more liberty. Liberty of designing interior the way you want and select the furniture without any compromises and so many other things. But spacious homes at the best location of the city come at very expensive price tag. If you have limited budget then you should find the best in your budget.

Tata Value Homes a subsidiary of Tata Realty is known for presenting luxury & spacious homes in one of the best locations of the cities at very attractive price. In Delhi NCR you can visit Tata New Haven Bahadurgarh and Tata Eureka Park in Noida.

Best Home Loan Option

Evaluating your Home Loan options

In India, from bank you can find home loan with different repayment plans. These days most of the Government & Private Banks are providing home loan at 6.80% - 7.50% interest rates. According to the banks, this existing interest rate is all-time lower. By evaluating all the available options you can select the best loan with the best terms.

Estimating your loan budget

First of all you need to realize that how much monthly installment you can afford to repay. As this cost will be a part of your fixed expenses from the moment you sign up for the loan and will continue for the next 15 – 20 years.

Avoiding first-time buyer mistakes

As we mentioned in the top paragraph, buying home for the first-time homebuyers is an exciting feeling. It is an investment that cost your lifetime savings & more, so you need to take every step carefully. That’s why we have listed some common mistakes that you should avoid.

- Finalizing property before applying for loan

- Not checking credit scores

- Not evaluate different loan options

- Spending above the fixed budget

- underestimate possible repair costs

If you think that finding a best home for your family is very tough task, you can take the help of professionals to avoid falling for scams and huge buying mistakes. You can also visit hcorealestate.com for best property options anywhere in India.