Women can also buy or acquire property and there are many initiatives are taken by government & local bodies to encourage the participation of women in properties.

Yes, this blog is about the benefits that women home buyers enjoy in India. But here we have to start from a major issue – Women in India have very good participation in households but very little in property ownership.

For ages, women have been bearing the tag of “weaker section” in our society. With gender inequality and gender-based discrimination, women are further forced to compromise their rights. In many parts of India, women have been deprived of their property rights, leaving them more or less dependent on the support of male members of the family. Now come to the current situation, there are huge differences in national statistics on ownership of women in the land as different agencies have their standards and assessment.

According to the India Human Development Survey Wave -II (2011-12) based on the names on property papers, only 15% of married women had this right, while for widowed women this figure went up to 41%. Married women whose husbands were absent had the lowermost homeownership rates on the other hand in households that had only women and children, slightly more than 1/4 women had legal ownership of the household.

Major Steps Taken by Government to increase women home ownership

- Government asking states to incentivize women’s land ownership through rural housing scheme

- Priority to be given to households where women made co-owners of land

- Suggests stamp duty exemption for houses under PM Awaas Yojana Gramin

- To use the rural housing scheme to empower women in rural areas.

Last but one of the best steps are taken by the government is - an amendment to the Hindu Succession Act (1956) was passed to provide equal rights to Hindu, Buddhist, Jain, and Sikh women to get their parent’s ancestral property.

Benefits That Woman Home Buyers Get in India

As more and more women stepping ahead for homeownership, now property developers, banks, and even local authorities are coming up with the best perks to make real estate a lucrative market for women. Here are some of the top advantages that a woman home buyer enjoys:

Banks Offer Lower Interest Rates to Women

Almost every bank in India offers comparatively lower home loan interest rates to women. For example, SBI charges 0.05% less from women. With this calculation, if the general interest rate is 7% p.a., the women will get the loan at 6.95%.

Let’s do more calculation

If you take the home loan of Rs. 50 Lacs for 20 years at the interest of 7% then your monthly EMI will be – Rs. 38765

As women in the same condition, your monthly EMI will be – Rs. 38615

Rs. 150 less per month.

Now many of you think, that this is not a big saving but if you multiply the same about from 20 (years) then you will save Rs. 36,000.

Let me make you clear, there is no such compulsion under law or RBI guidelines for banks to offer lower interest rates to women. While the lenders may have their own goals to do this, it is a good initiative.

Lower Stamp Duty

The land is the internal affair of every state and many states offer their own defined lower stamp duty for women home buyers.

For example, Maharashtra at this time offers a concession of 4% on stamp duty only for the women owners and 5% for men, saving of 1%. As you know, property in big cities like Mumbai is very expensive. So, this 1% can turn into big cost savings, suppose if the value of a residential property is Rs. 1 Crore and you are purchasing property in the name of your wife or mother then Rs. 1 Lacs is the immediate saving you can redeem.

And in Delhi, the stamp duty concession for women is 4% and men are 6% and 5% for the joint purchase with a woman, now you can estimate how much you can save. But not all states in India allow concession in stamp duty for women, a list of the states who are offering discounts on stamp duty is given below: -

- Bihar – male to female - 5.7%, female to male - 6.3% and other cases - 6%

- Haryana - for male - 7% in urban areas, for female - 5% in urban areas

- Maharashtra - 5% for male, 4% for female

- Odisha - 5% (male) 4% (female)

- Punjab - 7% (male) 5% (female)

- Rajasthan - 5% (male) 4% (female)

- Uttar Pradesh - male - 7% female - 7%-Rs 10,000

- Uttarakhand - male - 5% female - 3.75%

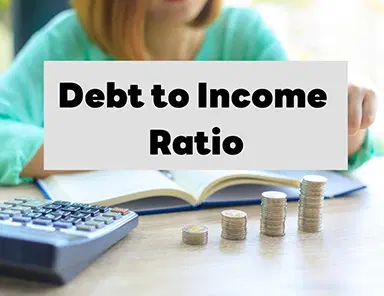

Increased Loan Eligibility and Tax Benefits

This provision is not particular for the women home buyers, but for joint loan borrowers. Only husband & wife who are working both can apply for a joint home loan and be eligible for the high loan value. In this case, the bank considers FOIR (Fixed Obligations to Income Ratio) while determining home loan eligibility.

How is FOIR Calculated?

Total Monthly Salary/Fixed Monthly Obligations X 100 = Fixed Obligations to Income Ratio

Lenders do not want that your Fixed Obligations to Income Ratio to exceed a certain percentage of monthly income. Ideally, your FOIR must be between 40% - 50%.

If any working couple is cooperatively applying for the home loan, the joint monthly income will be measured to analyze loan eligibility. And therefore, your eligibility home loan will be very good. Let’s describe this with the help of an example.

Shirish and Savita plan to buy a residential property. The net monthly income is Rs 1 Lacs each. At this time, Shirish has 2 ongoing loans and he pays a total of Rs. 22, 000 EMI but Savita has no loans.

If Shirish applies alone for a home loan, then he hardly gets the loan of Rs. 36 lacs with 7% EMI for the tenure of 20 years, as Shirish has an ongoing EMI of Rs. 22, 000.

So, if he needs a bigger loan than Rs. 36 Lacs then he needs to apply with their wife as their joint income is now Rs 2 lacs. As well as, Savita does not have any loans. As per the FOIR formula this couple can claim to loan up to Rs. 1 Crore.

Tax Benefits

You get a tax advantage for principal repayment (up to Rs 1.5 lacs yearly under Section 80C) and for home loan interest payment (up to Rs 2 lacs per annum under Section 24). These tax advantages are per person (and not per property). So, if the couple has taken a joint home loan, both get these tax benefits.

Can a girl buy a house in India?

Undoubtedly yes, a woman can buy a house in India, and that too with the benefits of lower stamp duty for women. Women home buyers have to pay only 2% of the property value as stamp duty.